Epsilon Research Valuation Platform now includes an access to IDMidCaps Equity Risk Premium (‘ERP’) on the French mid caps market. The premium is calculated every month by France's independent research provider IDMidCaps.

Estimating the risk premium on the shares market is one of the key issues under debate among finance professionals as well as within the academic sphere. A key element of the cost of capital, the use of ERP is becoming more widespread as the DCF method is now a standard approach for company valuations.

We selected IDMidCaps’s ERP as the most relevant for the valuation of French private companies, based on:

- IDMidCaps’ reputation, as the leading independent research provider on French mid caps;

- its innovative approach to ERP calculation: the methodology is rigorous in its principle and easy to implement (forecast approach based on the abnormal earnings model),

- the use of consistent and reliable data: 245 representative stocks of the French regulated small & mid caps market capitalising less than EUR1.5bn, followed by IDMidCaps since 2000, and chosen according to sectorial, capitalisation, liquidity and visibility criteria;

- the transparency of calculations & information given to customers (details of ERP components)

- the frequency of updates (monthly).

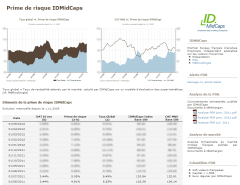

IDMidCaps Equity Risk Premium

IDMidCaps has developped an alternative method for the calculation of the ERP, with the support of a scientific committee led by Bruno Husson (affiliated tutor of the HEC group). This approach, traditional for company valuations, is based on a specific modeling of share value, based on the principle of abnormal earnings. Its advantage is that it notably reduces the sensitivity of the premium obtained to medium-long term assumptions.

Details of the methodology are given in the “ERP Methodology” document (see right column)

Information available to ERP subscribers

- Detailed data of the risk premium since Nov.2005 (expected rate of return, 10-y French government bonds, ERP), updated every month

- Graphs on the evolution of the ERP vs. Global Rate & ERP vs. CAC Mid&Small

- Quarterly IDMidCaps Study on the evolution of the ERP & French mid caps market

> Preview of information available