Epsilon M&A Deal Report - Verellen

Transaction Multiples for the Valuation of Private Companies

Scandinavian Tobacco Group > Verellen

Announced Date : 13 August 2014

Type : Acquisition of Majority Stake

Deal Value : Yes

Acquirer : Scandinavian Tobacco Group

Target: Verellen

Target Country: Belgium

Sector of activity : Food & Beverage Industry

Business Description :

> Established in 1868, Verellen produces cigars and cigarillos. > Also distribut ...

Transaction multiples available

| EV/Sales | EV/Gross Profit | EV/EBITDA | EV/EBIT | Eq/PBT | P/E | Price to Book | |

|---|---|---|---|---|---|---|---|

| Historic | |||||||

| Current |

: Multiple available

n.s : Multiple calculated, but not significant

Rating **

Source: Epsilon Research / EMAT

Comparable Transactions

Number of EMAT Reports : (Food & Beverage Industry) = 750

Example of comparable transactions on EMAT (same sub-sector):

| Date | Acquirer | Target | Country | Multiples | See details |

|---|---|---|---|---|---|

| 27/07/2009 | Private Group backed by NBGI Private Equity | Boulangerie Thierry (Groupe SPM - Société de Panification Moderne) | France | * | |

| 30/08/2006 | Private Group backed by Sofiproteol, Unigrains, Uni expansion Ouest | Valorex | France | * |

Source: Epsilon Research / EMAT

This report is accessible on EMAT, the reference database for private company acquisition multiples

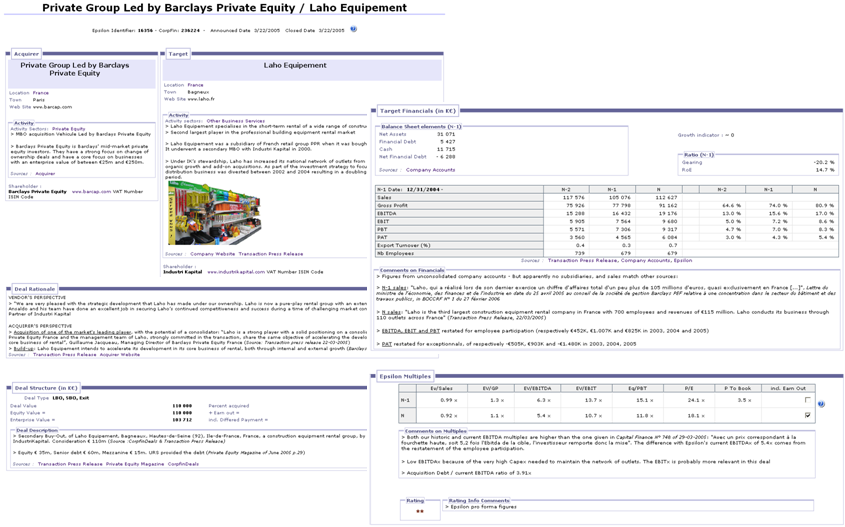

Example of EMAT Report : click here

View Complete ReportEpsilon Research is an independent research and financial analysis bureau, and the reference source of transaction multiples for the valuation of private companies through its EMAT database.

Sectors covered by our analysts

Studies & indices published by Epsilon Research Register to receive (free) publications updates

Each EMAT Report includes the detailed analysis of the transaction: deal rationale and structure, target business lines and financials (restated), valuation multiples (calculation and analysis).

Sign up (free) to receive by e-mail updates on EMAT reports published on your preferred sector.

Subscribe to EMAT database