Sectors of Activity

Transaction Multiples

Monitoring of the "Sectors of Activity" industry and publication of analysis reports

Our analysts publish transaction multiples reports for private company M&A deals (announced 2004 onwards).

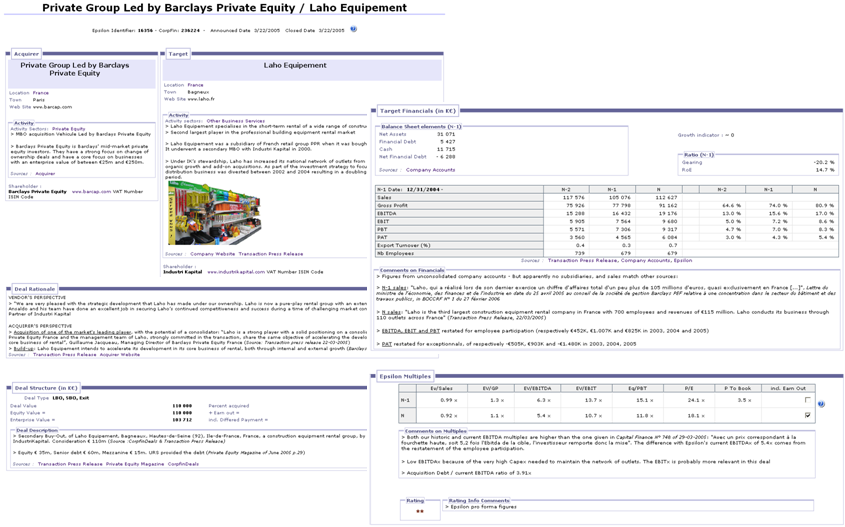

Each report presents detailed information on the deal value, structure and rationale, the target's activity, history and financial information; it includes the calculation of the key historic and current multiples: enterprise value over sales (EV/S), EBITDA (EV/EBITDA), or EBIT (EV/EBIT), P/E and Price to Book. All information sources are systematically given and company financials are carefully verified and restated if needed.

The reports are a unique source of information to have a comparable metric for the valuation of a private company, establish the "market value" of an investment or private equity investment portfolios.

The deal reports are published in Epsilon's EMAT database.

For an example of EMAT report, please click on this link.

If you wish to buy an EMAT Report, and you are not a customer, please contact us

Epsilon Research covers the M&A transactions for the "Sectors of Activity" industry [15625 EMAT Reports] which includes:

- Energy and Basic Resources

- Chemicals

- Construction & Building Materials

- Agricultural Sector

- Metals

- Industrial Goods

- Electrical / Electronic Equipment

- Transport Equipment & Manufacturers

- Personal & Household Goods

- Food & Beverage Industry

- Health, Pharmaceuticals & Biotechnology

- Retail and Wholesale ('R&W')

- Transports

- Hotels Restaurants and Bars

- Media - Communication

- Business Services

- Consumer Services

- Financial Services

- Software

- Internet

- IT Services

- Telecommunication Services

- Technology Hardware & Electronic Equipment

- Real Estate

- Environment and Climate Change

Sign up (free) to receive by e-mail updates on EMAT reports published on your preferred sector.

SubscribeEpsilon Multiple Analysis Tool - The Reference Source for Private Company Acquisition Multiples

Each EMAT Report includes the detailed analysis of the transaction:

deal rationale and structure, target business lines and financials (restated), valuation multiples (calculation and analysis).

Example of EMAT Report