Epsilon M&A Deal Report - Positive Group (Sarbacane Group)

Transaction Multiples for the Valuation of Private Companies

Private Group led by EMZ Partners > Positive Group (Sarbacane Group)

Announced Date : 20 September 2022

Type : MBO (Management Buy Out)

Deal Value : Yes

Acquirer : Private Group led by EMZ Partners

Target: Positive Group (Sarbacane Group)

Target Country: France

Sector of activity : Software

Business Description :

> Founded in 2001 by Mathieu Tarnus, Groupe Positive is a software editor focused on communicatio ...

Transaction multiples available

| EV/Sales | EV/Gross Profit | EV/EBITDA | EV/EBIT | Eq/PBT | P/E | Price to Book | |

|---|---|---|---|---|---|---|---|

| Historic | |||||||

| Current |

: Multiple available

n.s : Multiple calculated, but not significant

Rating *

Source: Epsilon Research / EMAT

Comparable Transactions

Number of EMAT Reports : (Software) = 1761

Example of comparable transactions on EMAT (same sub-sector):

| Date | Acquirer | Target | Country | Multiples | See details |

|---|---|---|---|---|---|

| 21/06/2020 | Private Group led by Silver Lake | Silae | France | * | |

| 01/03/2022 | Private Group led by Partners Group | Foreterro Group | United Kingdom | ** |

Source: Epsilon Research / EMAT

This report is accessible on EMAT, the reference database for private company acquisition multiples

Example of EMAT Report : click here

View Complete ReportEpsilon Research is an independent research and financial analysis bureau, and the reference source of transaction multiples for the valuation of private companies through its EMAT database.

Sectors covered by our analysts

Studies & indices published by Epsilon Research Register to receive (free) publications updates

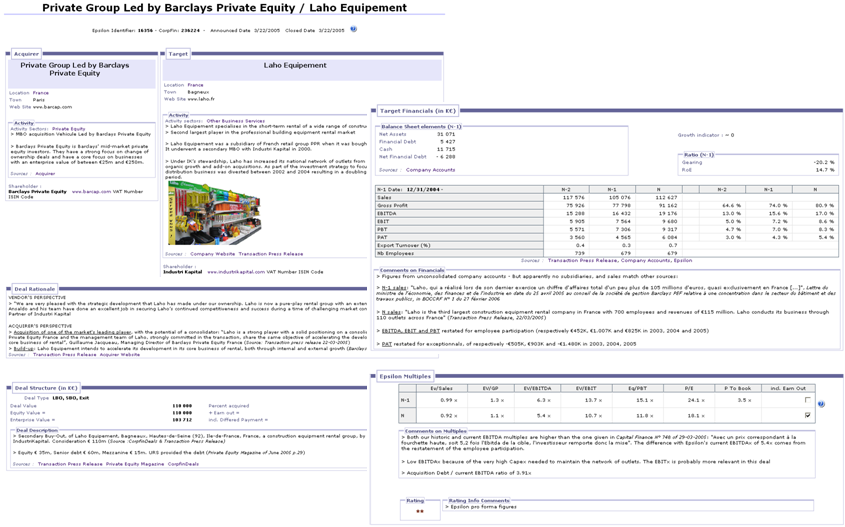

Each EMAT Report includes the detailed analysis of the transaction: deal rationale and structure, target business lines and financials (restated), valuation multiples (calculation and analysis).

Sign up (free) to receive by e-mail updates on EMAT reports published on your preferred sector.

Subscribe to EMAT database